At Greenlion we know our clients have used trusts for eons to protect wealth, pass assets to heirs and minimize tax liabilities. We also know these benefits prevail, providing trusts are administered and managed in accordance with the law.

Recent legislation has resulted in a greater scrutiny of trusts and trustees’ behavior. Particular disclosures to IRD are now required annually. Beneficiaries’ rights have been strengthened too, making it easier to hold trustees to account. Knowing how to administer and manage a trust these days can seem a daunting exercise.

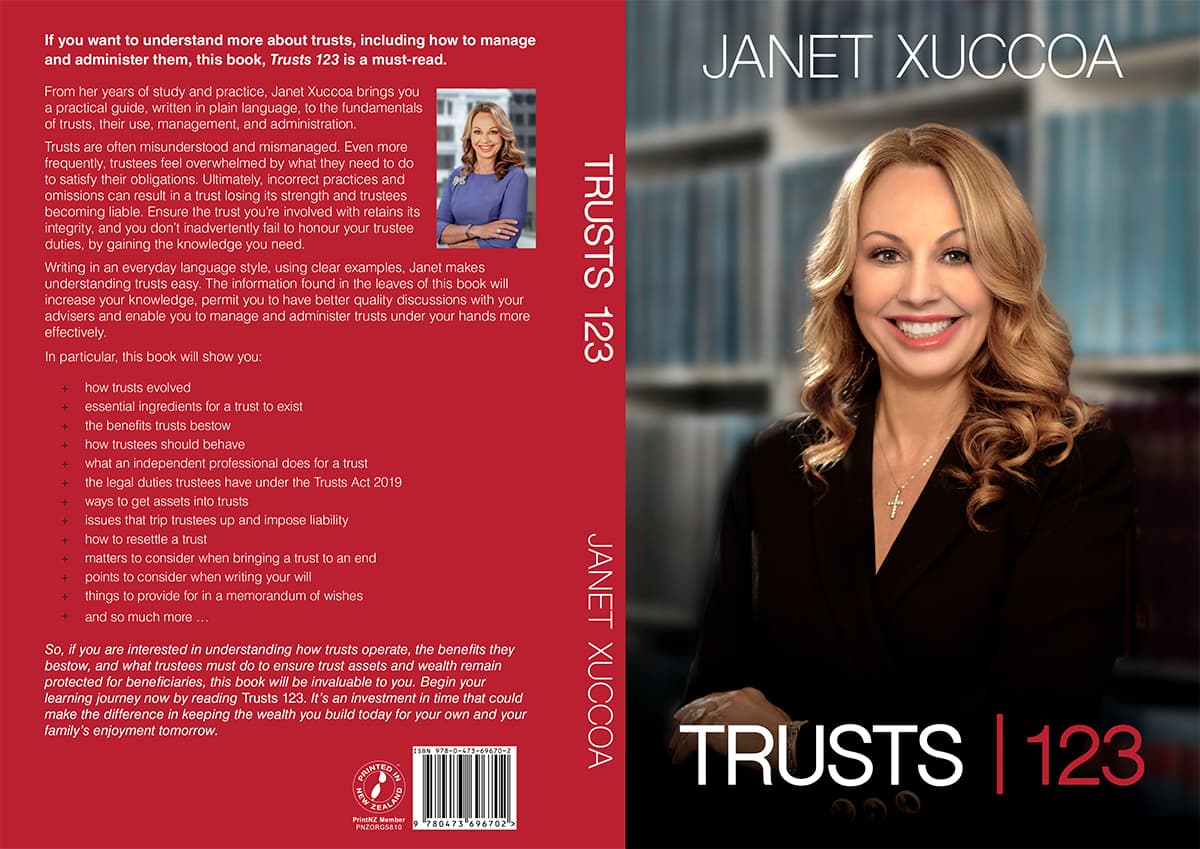

What must trustees do to comply with the law? How do trustees ensure their trust survives an audit and an attack? What can trustees do if one trustee loses mental competence? How can beneficiaries get trustees to provide them with information? Answers to these questions and more can be found in Janet Xuccoa’s new book Trusts 123.

Written in a clear, straightforward, easy to understand manner, Trusts 123 is an essential read for those involved with trusts.

We’ve managed to obtain a limited number of books for our clients at $19.95 + postage – that’s a 50% saving on retail price. If you wish to order a copy, fill in your details or contact your Greenlion Advisor.